CHAPTER 18

Accounts Receivable

Mastery of the content in this chapter will enable the reader to:

• Explain insufficient funds charges.

• Describe the process used to accept payments on client accounts.

• Define and enforce a no-charge policy.

• Describe the process used to collect outstanding accounts receivable effectively.

• Define the Fair Debt Collection Practices Act.

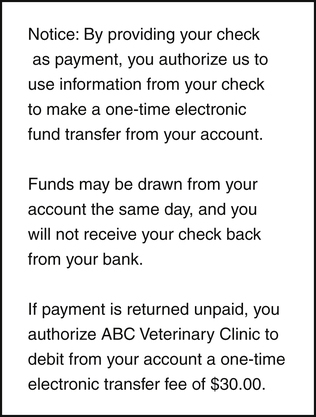

Checks returned for insufficient funds are a common problem for practices that do not use a check machine. Practices may try to collect these balances themselves or hire an outside collection agency to collect the funds. Returned check fees must be applied to the client account to recoup bank charges, lost time, and money (Figure 18-1). If a collection agency collects the delinquent amount, service fees will be deducted from the check total once it has been collected. Most companies add a $30 service fee for returned checks. A notice that is clearly visible to clients must be posted indicating all fees that will be added to a client’s account if a check is returned.

INSTITUTING A NO-CHARGE POLICY

Signs should be clearly posted for clients to see throughout the clinic regarding a no-charge policy. Signs should say, “Full payment is required at time of service” (Figure 18-2). Although some practice owners believe this message is simple and to the point, it is unfortunately not adequate. Estimates must be given to all clients, regardless of client “status,” for all services that are expected to be rendered for that patient. Team members can print out an estimate, verbally review it with owners, and explain all procedures and medications the pet will be receiving. The client should sign the estimate; this gives the practice legal documentation that the client accepted the services that the veterinarian has recommended. Clients need to clearly understand that a deposit of at least half of the estimate is required before procedures are performed, and the remainder is due when the animal is released from the hospital.

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree

PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT