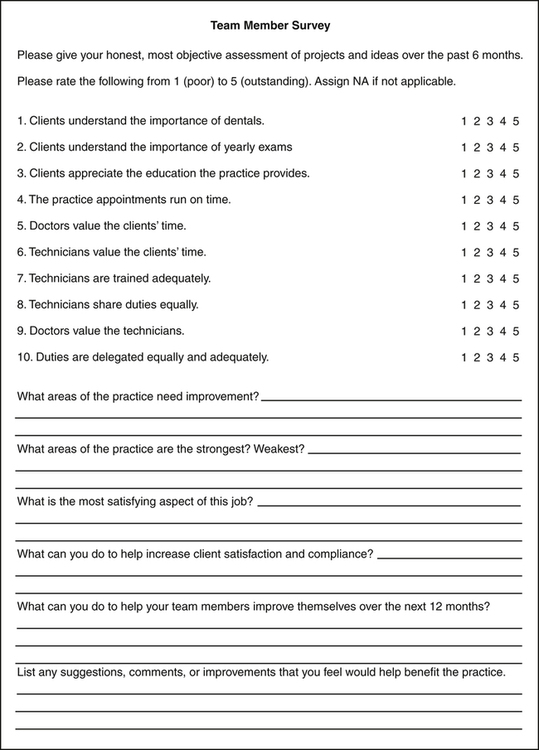

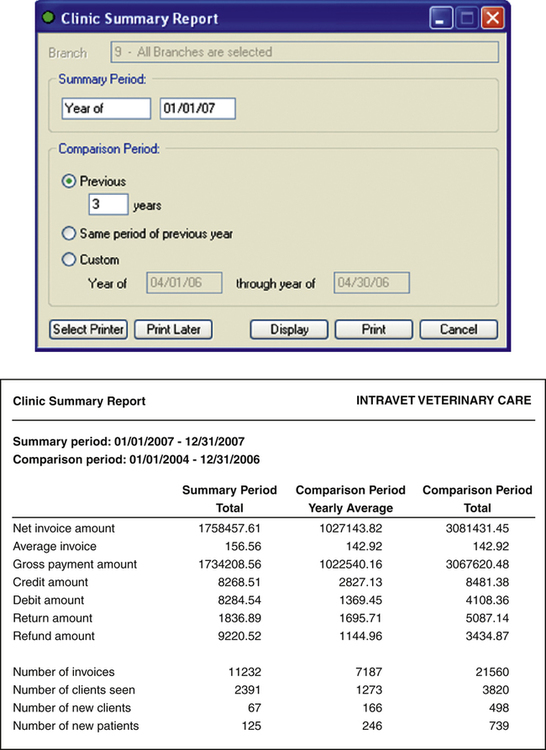

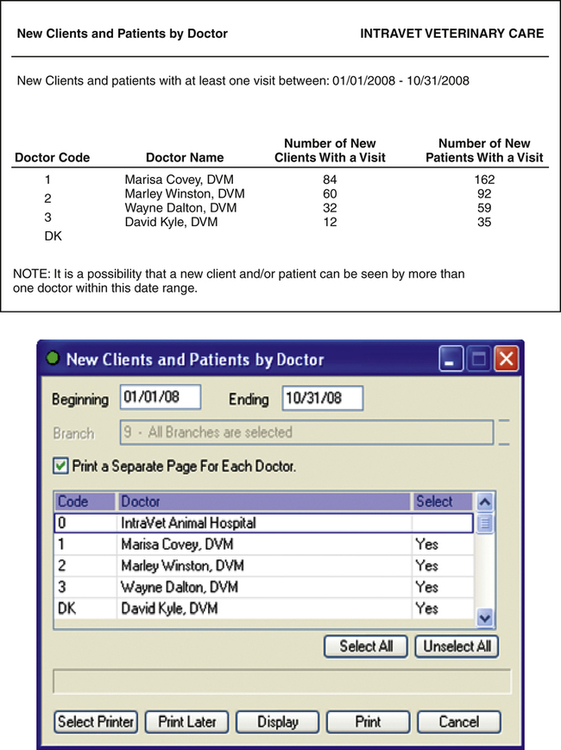

CHAPTER 20 Mastery of the content in this chapter will enable the reader to: • Identify the differences between bookkeepers, accountants, public accountants, and certified public accountants. • Define the basics of accounting. • Correlate effective key performance indicators. • Develop an equipment budget. • Describe methods used to purchase equipment. • Identify profits and profit centers. To understand budgeting, a few accounting terms must first be reviewed. This will help in the understanding of creating and maintaining budgets. Box 20-1 lists helpful terms. A variety of basic information is needed when compiling reports for a veterinary hospital. These statistics are also known as key performance indicators. These reports help monitor the practice on a monthly, quarterly, and yearly basis. Key performance indicators can help explain changes in financial statements, and all contribute to the success of the hospital. Practices should take time to develop their own set of key performance indicators, determining what reports are needed and what aspects of the practice that management wants to focus on (Figures 20-1 and 20-2). Following are some examples of reports: • Accounts payable, total of owed amount and due dates • Cash available for investment • Inventory of equipment owned with original purchase date and price • Inventory sold within a given period • Number of employees and the total number of hours worked per payroll period • Taxes owed; payroll, sales, and other An accounts payable ledger will help monitor expenses on a monthly basis (Figure 20-3). A team member can add invoices as they arrive as well as enter a due date and the amount of the payable. This ensures bills will not be overlooked and gives a running balance of those accounts with revolving credit lines. It also allows easy access to retrieve information if the payment of a specific bill comes into question. Figure 20-4 is an AR report that shows that the largest balance of the accounts receivable is the current amount due, followed by 90 days past due. The sum of $3661.32 is unlikely to be collected, and the AR manager must determine appropriate strategies to collect these funds as soon as possible. The current balance must also be monitored; if this balance does not decrease within 30 days, strategies must be implemented to prevent past due amounts from rolling over to 60 and 90 days past due. Chapter 18 discusses AR in more detail. Client surveys are an easy monitoring solution to understand the satisfaction and level of client comfort with the services the practice provides (Figure 20-5). Clients maintain the business; therefore it is imperative to make sure they are satisfied and perceive the value of the service provided. If clients are unsatisfied, practices want to be notified and given the opportunity to address the problem. Hospitals do not want to lose clients or have negative comments made about them throughout the community. It is very important to strive for a high level of satisfaction from every client. Monitoring client compliance rates is useful in many ways. If clients are accepting recommendations, then the staff is doing an excellent job of educating clients and clients perceive the value in the services that are advised. Second, client compliance drives profits. The client relationship has already been established, and it is essential to maintain that relationship. It is easier to maintain relationships than to build new ones. Compliance reports should include reminder compliance as well as the profit centers the practice has chosen to monitor (Figure 20-6). Figure 20-7 lists equipment that was purchased before and after the practice manager began a capital inventory list. Anesthesia machine #1 was purchased before the list was developed. However, the model number and serial number are available for reference in case a fire or theft ever occurs. Anesthesia machine #2 was purchased in December 2003 for $400 as one unit. This is valuable information, along with the name of the manufacturer, in case a machine malfunction occurs and warranty dates come into question. A column could be added for warranty expiration dates, which would also help the practice manager. The number of active clients in a practice is a benchmark number and allows comparison with other practices in the region. The definition of active can vary from practice to practice; therefore it is much more effective to measure from year to year for the same practice. If the number of active clients is low, this may indicate the need for further internal and external marketing techniques. Internal techniques such as reminder systems should be evaluated for effectiveness, and external techniques may be developed. See Chapter 10 for more internal and external marketing tips. Payroll is important to monitor because overtime can eat practice profits. A payroll budget should be created, allowing raises when needed with flexibility to add additional team members if needed (Figure 20-8). Payroll and payroll taxes are a large portion of expenses and must be monitored closely. Payroll budgets are discussed at length later in this chapter and include estimation for taxes. Overtime is not estimated; team member schedules and hours should be monitored closely to cut this undesirable expense. Tax ledgers can be beneficial when paying monthly bills, preventing overspending. Quarterly taxes can be shockingly high and must be budgeted for when paying current accounts payable. Figure 20-9 lists the history of tax payments as well as those due for the month of April 2009 Team member surveys should vary by position. Figure 20-10 gives examples for veterinary technician responsibilities. The survey could also include how team members value other positions within the practice as well as how they feel each department completes its tasks. Each department and/or position affects other departments or positions in a practice and must be considered. Cost of goods sold (COGS) is also known as cost of professional services (COPS); these phrases can be used interchangeably. COGS or COPS represents the direct costs associated with producing a service or product. It covers the direct costs of patient care and product sales, drugs, supplies, and laboratory fees (Box 20-2 and Figure 20-11).

Preparing and Maintaining a Budget

ACCOUNTING BASICS

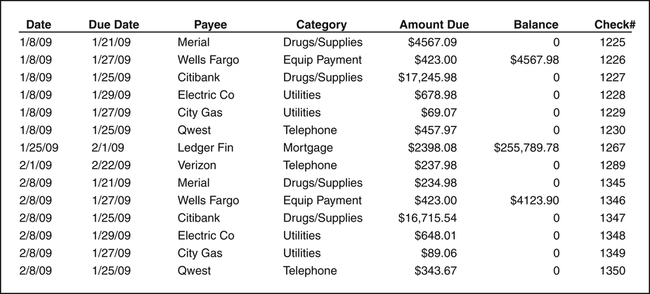

Accounts Payable

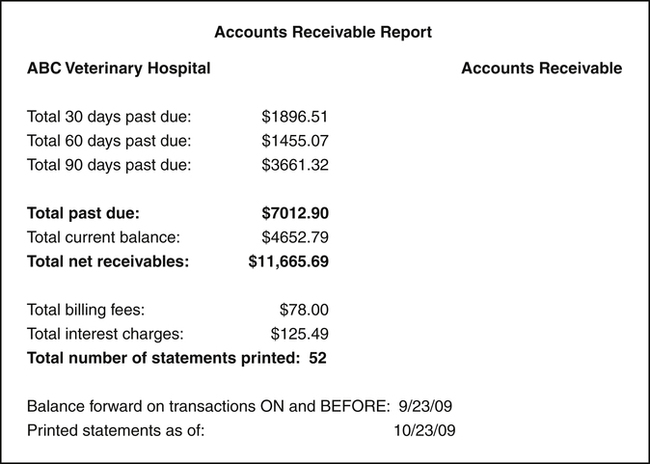

Accounts Receivable Summary

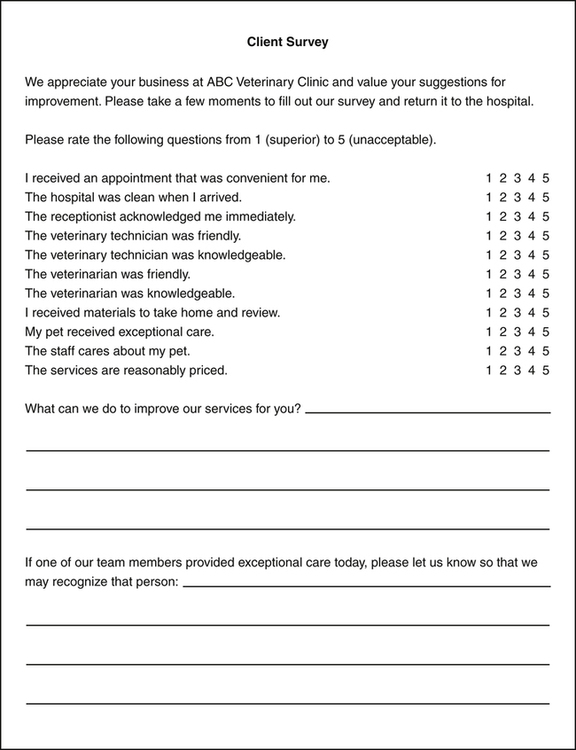

Client Surveys

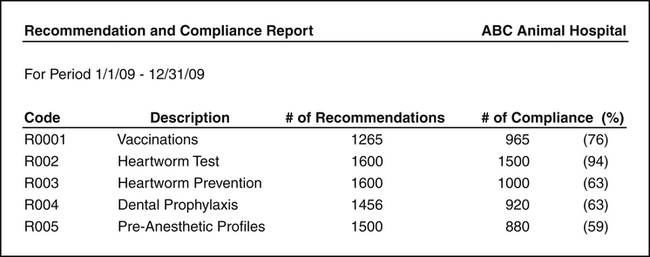

Compliance Rate

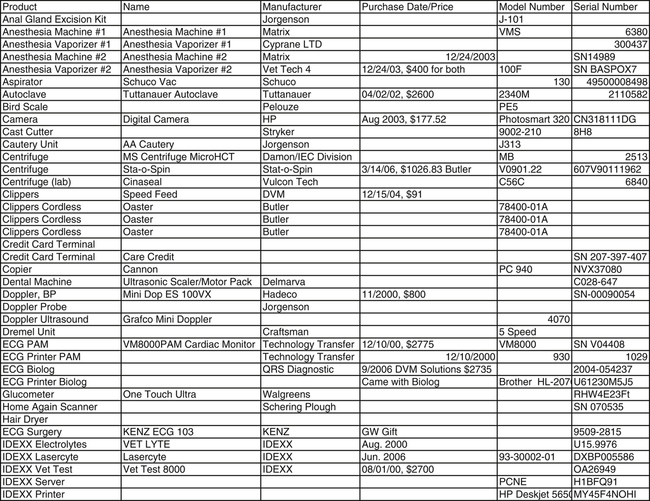

Inventory of Equipment

Number of Active Clients

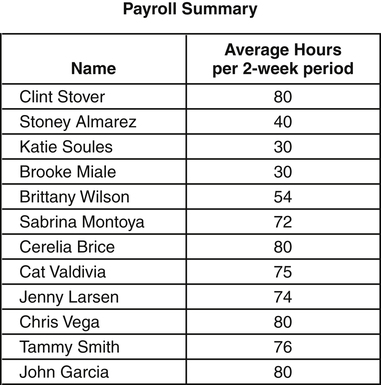

Number of Employees and Total Number of Hours Worked per Payroll Period

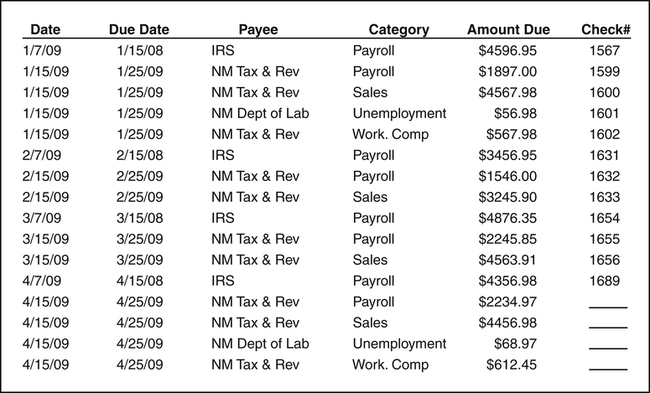

Taxes Owed

Team Member Surveys

CREATING A BUDGET

Cost of Goods Sold and Cost of Professional Services

Preparing and Maintaining a Budget

PRACTICE POINT

PRACTICE POINT

PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT PRACTICE POINT

PRACTICE POINT

What Would You Do/Not Do?

What Would You Do/Not Do?