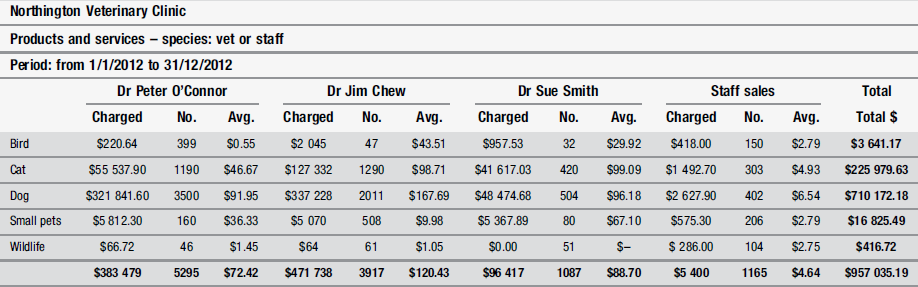

15 Late in 2012, Peter was audited by the taxation department for not paying Goods and Services Tax (GST), but in fact it was Marge who had not done so. Peter received a $12 000 fine and now has to pay back payments of $53 000 to the taxation department. Small amounts of money have also gone missing. A daily reconciliation of transactions is kept but it rarely balances. Different clients come in each month, as they have been getting accounts in the mail, but claim that they have already paid (see Tables 15.2 and 15.3). Although he is the practice owner, Peter does not consider details such as the income statement, fee schedules, staffing budgets and service reports as important. As long as there is a small amount of money in the bank to support his annual holiday and conference then he is satisfied. However, the clinic’s income has plateaued over the last 18 months, and since the taxation debacle cash flow has been especially poor. Fortunately, Marge maintains the debtors, creditors and general ledger systems adequately for extraction of information to go to both the accountant and, on occasion, into a practice benchmarking service. This practice benchmarking service enables a practice to compare its key financial performance indicators to other similar Australian veterinary practices. NVC’s software program also allows further custom reports that include further species and transaction analysis (see Tables 15.1–15.8 and Figure 15.1).

Northington Veterinary Clinic

a new lease of life?

The problem

A taxing time

![]()

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree

Northington Veterinary Clinic: a new lease of life?